arizona solar tax credit 2019

The federal solar tax credit gives you a dollar-for-dollar reduction against your federal income tax. 23 rows ADOR will be sending renewal letters to filers to renew their 2023 Arizona Transaction Privilege Tax License.

Colorado Solar Incentives Tax Credits Rebates Guide 2022

This fillable is for taxpayers who need a plain fillable Form 140PY.

. An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan. Here are the specifics. Arizona solar tax credit.

Arizona Solar Tax Incentive. Arizona Department of Revenue tax credit. AZTaxes filers must renew online.

A nonrefundable individual and corporate tax credit for installing one or more solar energy devices for commercial or industrial purposes in the taxpayers trade or business. Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit. Arizona has the Arizona Solar Tax Credit.

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. Part-Year Resident Personal Income Tax Return Non-calculating fillable Part-Year Resident Personal Income Tax Return. 26 rows Property Tax Refund Credit Claim Form -- Fillable.

It is a 25 tax credit on product and installation for both 2020 through 2023. The 25 state solar tax. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

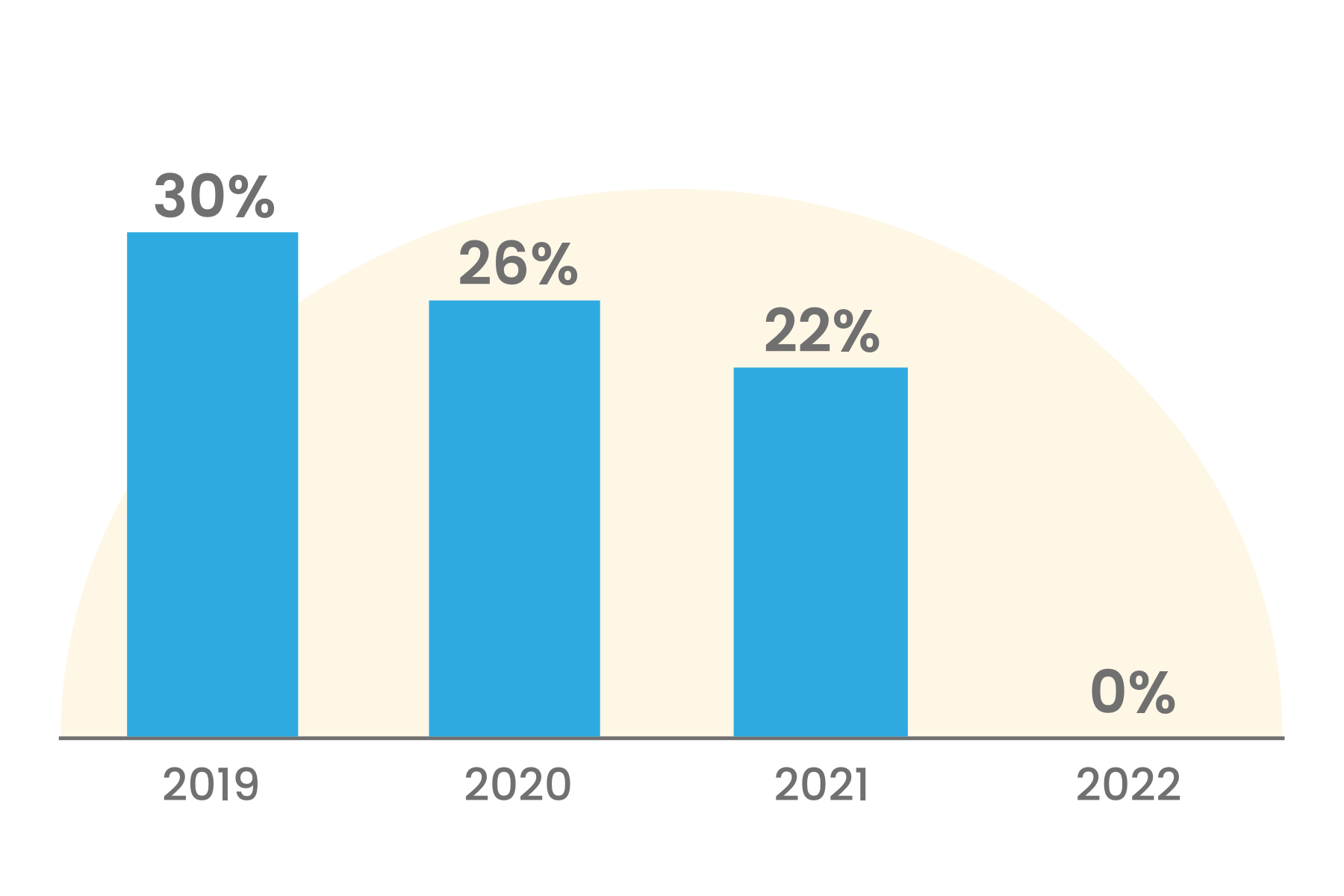

The federal solar tax credit gives you a dollar-for-dollar reduction against your federal income tax. Arizonas Tax Incentives and Solar Rebate Programs. The Solar Tax Credit ITC will be reduced by 4 after 2019.

Worth 26 of the gross system cost through 2020. Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. The Solar Tax Credit ITC will be reduced by 4 after 2019.

2 According to our market research and data from. Arizona solar tax credit 2019 Monday March 21 2022 Edit. In 2019 the maximum credit allowed for single.

The 30 tax credit applies as long as the home solar system is installed by. This means that in 2017 you can still get a major discounted price for your. The federal residential solar energy credit is a tax credit that can be.

Summary of solar rebates in Arizona. The 26 federal solar tax credit is available for purchased home solar systems installed by December 31 2022. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable.

Part-Year Resident Personal Income Tax Return Non-calculating fillable Tax Credits Forms. The Arizona income tax credit for solar panels is 25 of your systems installed costs or 1000 whichever amount is less. Arizona Solar Tax Incentive.

The 30 tax credit applies as long as the home solar system is installed by December 31. In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was. IRS Form 5695 for 2020.

Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes. The tax credit remains at 30 percent of the cost of the system. Renewable Energy Production Tax Credit.

IRS Form 5695 for 2019. AZ Form 310 for.

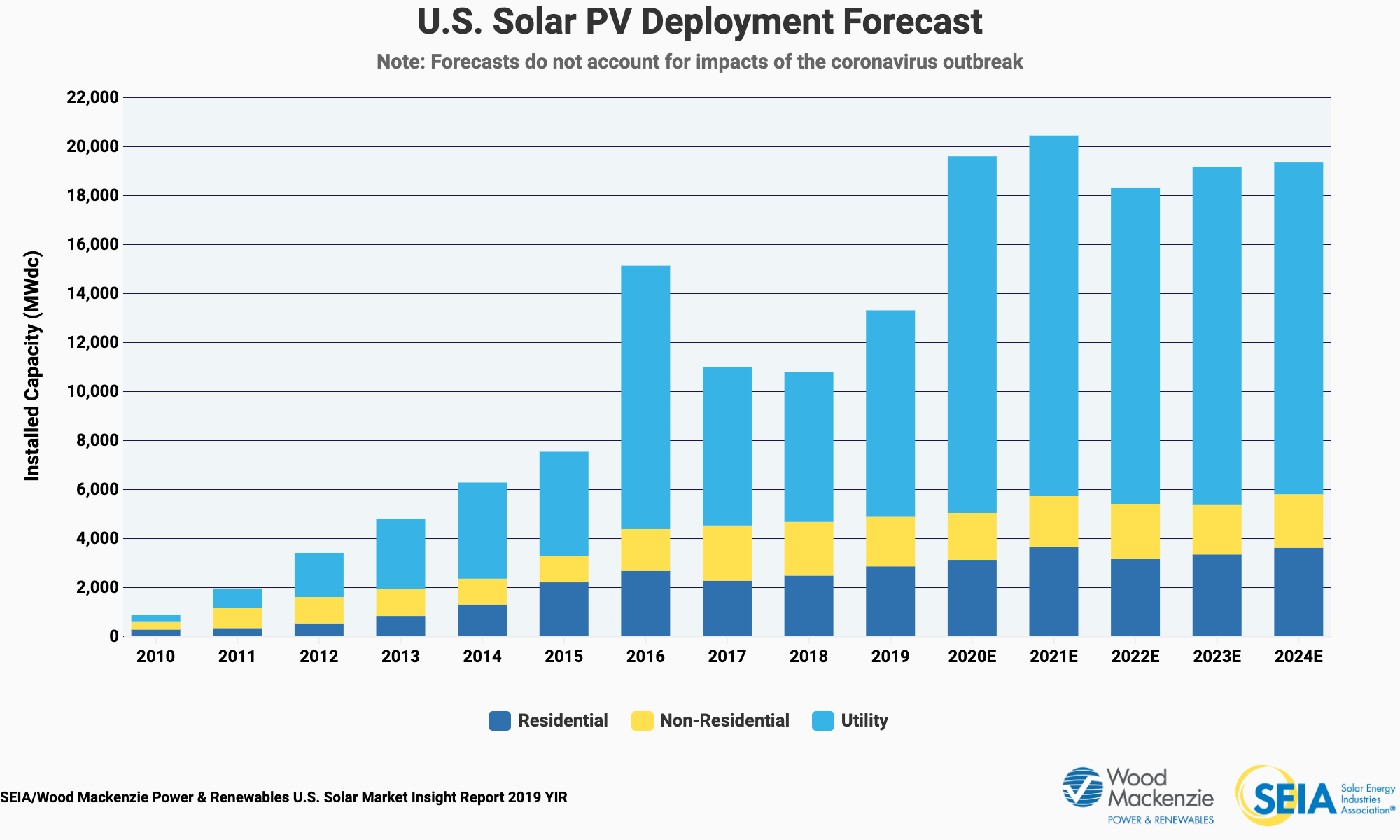

How The Investment Tax Credit Other Incentives Drive Solar Energy

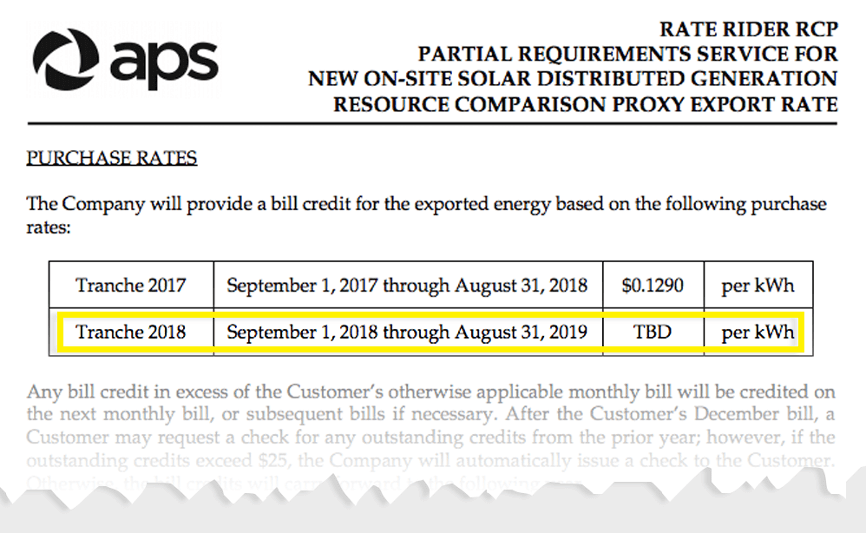

4 Reasons To Go Solar Before The Aps Deadline Green Living Magazine

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Njdep Air Quality Energy Sustainability

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

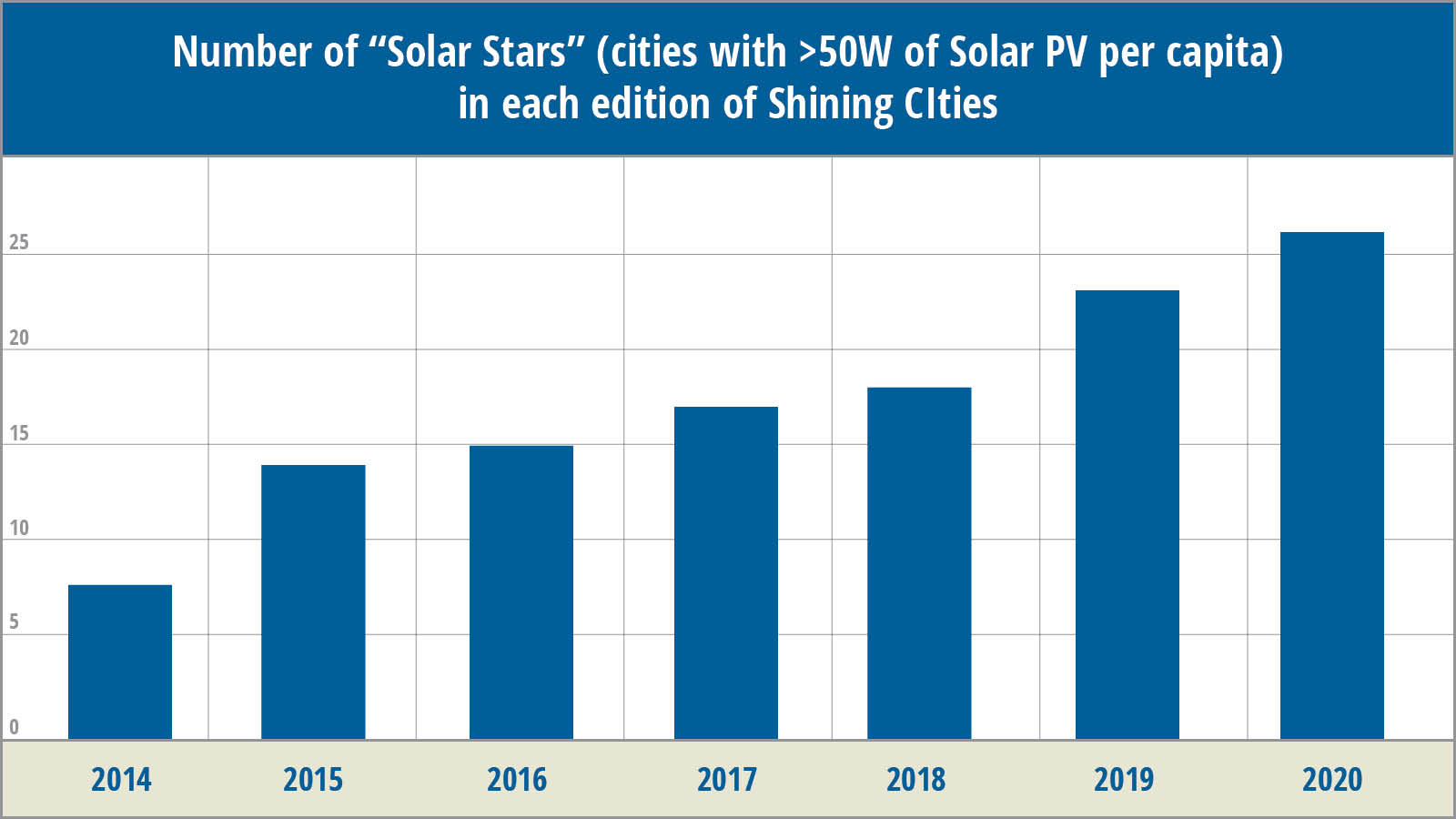

Shining Cities 2020 Environment America Research Policy Center

Solar Tax Credit 2021 Extension What You Need To Know Energysage

How The Solar Tax Credit Extension Will Affect New Solar Customers Through 2019

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

Upcoming Changes To The Solar Tax Credit And How They Affect You

How Much Do Commercial Solar Panels Cost Kake

Everything You Need To Know About The Solar Tax Credit

What S The Maximum Size Solar System You Can Install Freedom Forever

U S Energy Information Administration Eia Independent Statistics And Analysis

Georgia Solar Incentive Tax Credit And Rebate Guide 2022

Home Solar Panel Adoption Continues To Rise In The U S Pew Research Center